Banking and Finance

Financial Analytics

- Businesses require information right on time to facilitate decision-making processes

- Companies need stringent financial planning and prediction

- Financial analytics is the need of the hour, considering the rapid advancements in tech, diverse demands of the traditional financial sector, and the introduction of new business models

- The future goals of an enterprise can benefit from the improved decision-making strategies with financial analytics

- Tangible assets of a business can be managed better with financial analytics

- The profitability of a company can improve with the in-depth insight financial analytics bring

Credit Scoring

Credit scoring models powered by AI provide an evaluation of data that is comparatively more nuanced than the traditional credit scoring model and can even take into account the data that would previously be deemed irrelevant.

Our credit scoring model reduces credit risk with the ability to increase pass rates while maintaining or reducing current default risk. Our solutions will take manual underwriting to the next level through AI automated decision-making and recommendations that are transparent and explainable to the end-user. Additionally, an AI credit scoring model would be self-learning and would continuously improve itself with the introduction of new data into the system.

Fraud detection and prevention

The cutting-edge technology of Machine Learning accurately and automatically detects threats and takes action against them in the shortest possible time. The efficiency of Machine Learning has the financial sector, regulators, and governments investing heavily in security risk management.

We ensure our Fraud Detection algorithms do not affect your customer experience. In addition, we provide:

- Real-time and batch data integration

- Out-of-the-box alert scenarios

- Fully audited workflow and case management

- High-performance scenario testing tools

- Rapid roll out

- Pre-defined reports for investigations and operational performance

Smart Advisory and Individual Wealth Management

Big data and AI has altered the way wealth management professionals execute their tasks. AI has nuanced the traditional “cookie-cutter” approach that categorized the trading preferences of clients as aggressive, conservative, or balanced. Wealth managers and financial advisors can now use AI to get a better understanding of client requirements. AI sentiment analysis can be applied on social media data, and information of customers can be used to derive insights about their present and future financial condition.

Trade solutions

Analyzing complex sets of data AI, through machine learning, identifying unsuccessful trades, its underlying causes and rectifying the same has become easy with AI machine learning. The accelerated remediation of rejected trades has several advantages for financial institutions including the prevention of expensive consequences, market losses, adverse impact on clients, and trading limit or regulatory violations.

Automating Customer Service

AI brings with it chatbots, text, and voice analytics among other use cases. The increasing adoption of these applications is speculated by customer service decision-makers to change the customer and employee experience.

Customer Retention

Companies can implement AI-powered solutions to encourage customers at different stages of the user life cycle to opt for a predetermined action. Getting an insight into the preferences of consumers and using past behaviors to determine the subsequent most appropriate action to be taken is an area where AI or machine learning solution can help to a great extent.

AI insurance

AI and cognitive technologies are especially advantageous to the data-heavy insurance industry and are considered a disruptive force in the space. It streamlines processing large volumes of diverse data, claims, and customer queries.

Healthcare

Machine learning is improving diagnostics, predicting outcomes, and beginning to scratch the surface of personalized care

Medical Registry Automation

Features and benefits of Medical Registry Automation are many. Healthcare organizations are opting for advanced analytics tools to derive insights from data to reduce costs and improve the patient experience.

- Enable self service by letting patients submit required intake forms and documents via web portals or mobile devices.

- Eliminate manual data entry which is costly and error prone.

- Ensure registration information is audit-ready with automatic control over signed forms.

- Improve accuracy and availability of patient registration information.

- Deliver full chain of custody and audit of the capture process.

- Create a faster and more efficient patient onboarding process.

- Facilitate superior patient experience and increase patient satisfaction ratings.

Automatic ICD Coding

The complexities incumbent to ICD makes it susceptible to errors since the frequent use of abbreviations in diagnosis leads to faulty matching to ICD codes. Furthermore, many-a-times two diagnoses that are very similar to one another are encoded in a single combination ICD code. Cases, where doctors write one diagnosis that corresponds to multiple ICD codes, are also not rare. For efficient coding, the process involves a comprehensive understanding of each patient’s health condition.

Unfortunately, medical practitioners rarely possess the required training in professional coding, which brings us to a high-tech solution offered by us to resolve the industry-wide ICD coding issue. Our experts have introduced a deep learning model that is attention-driven and automatically translates doctors’ diagnoses into the corresponding ICD codes without any errors. Our designs include various recurrent neural networks that enable the model to differentiate the multiple types of ICD definitions and accurately identify unclear semantic information. Our model brings a mechanism of attention to allocate unassociated weights to each diagnostic description a medical practitioner writes to resolve the mismatch between ICD codes and written diagnoses.

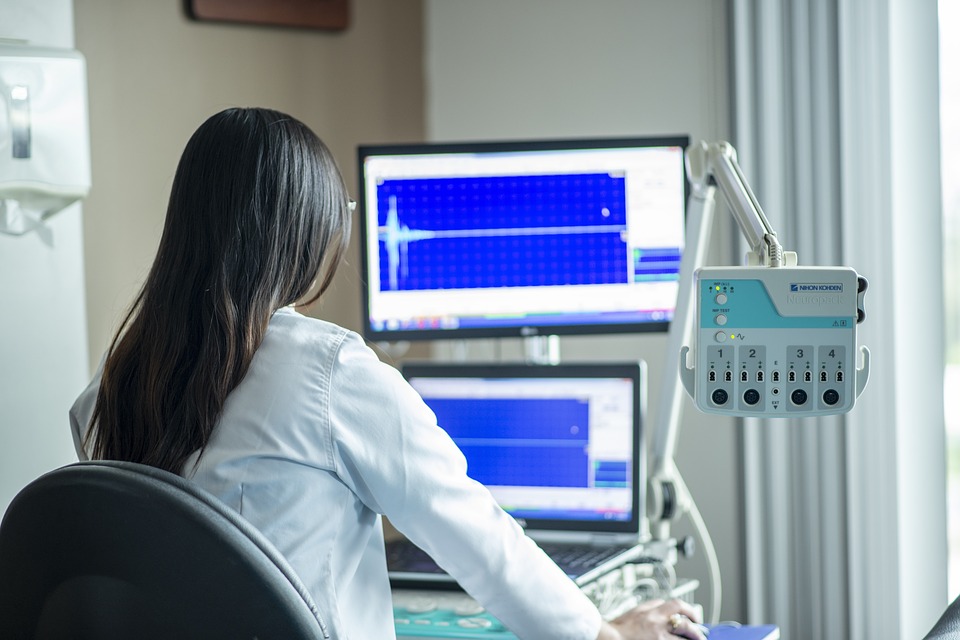

Imaging Report Generation

From a subjective perceptual skill, Radiology is transforming into an objective science. With the amount of data increasing exponentially, the need for AI to identify nuances undetectable by the human eye becomes stronger.

Radiologists stand to benefit from AI since it will allow them to focus on other value-added tasks and participate in multidisciplinary clinical teams.

Travel

Customer segmentation and personalization

Segmentation and personalization practices have their obvious benefits with disciplining the data and taking individual care of the customers and their preferences thus enhancing the customer experience. This also facilitates companies to avoid spam and reach target customers with the intended message at the right time.

Flexible pricing solutions

In tune with personalization of customers’ data, it is possible to tailor their pricing corresponding to packages and itineraries customized in line with customer's preference.

Intelligent travel assistance and chatbots

The goal is to simplify the overall customer experience. With AI-based virtual assistants guiding the flow, the planning and booking processes are rendered smooth.

Sentiment analysis

NLP is employed to derive sensible information out of unstructured data to facilitate sentiment analysis. This load of gathered insights, merged with those collected from other sources is utilized for determining customer’s choices and preferences with unprecedented accuracy; thus making way for enhanced customer experience.

Predict demand

Artificial intelligence and machine learning are poised to revolutionize demand forecasting. AI gives demand and financial planners breakthrough capabilities to extract knowledge from massive datasets built from a multitude of internal and external sources. Implementing machine learning algorithms discovers insights and recognizes trends overlooked by human-configured forecasts.

Big data and immense computing power in the cloud enable AI to test and refine hundreds of advanced models simultaneously. Organizations using AI can choose from several options of how it will be applied in demand forecasting, and predict autonomous actions based on cognitive automation.

ECommerce

Sales forecasting

AI is equipped to study trends, recognize patterns and detect inconsistencies. This feature helps identify repeated trends in the purchasing behavior of consumers to foresee slumps and spikes in sales. This information enables reduction of cost of storage by preventing spoilage and ordering the exact quantity.

Individualized shopping and suggestions

AI helps personalize customer experience by studying their prior choices and serving them an assortment based on their preferences. Higher knowledge about the user base creates opportunities to change content and offer timely discounts dynamically.

Fraud detection

Fraud detection algorithms can sieve out the fake reviews through sentiment analytics and single out suspicious activities and scams.

Customer support automation and chatbots

Trained bots with human-qualities serve as customer service executives and are always available equipped to deal with urgent requests.

Voice assistance

Voice assistance is of immense help to individuals with infirmities and children rendering this capacity extremely popular. This feature is built in various products and home devices for functionality and entertainment.